FwFLC

Family Loan Calculator by FAMware (Free)

FwFLC

Family Loan Calculator by FAMware (Free)

Product Info

FAMILY LOAN CALCULATOR will help you pay off your loans more quickly and get out of debt, or estimate what monthly payment you can afford before borrowing.

Features:

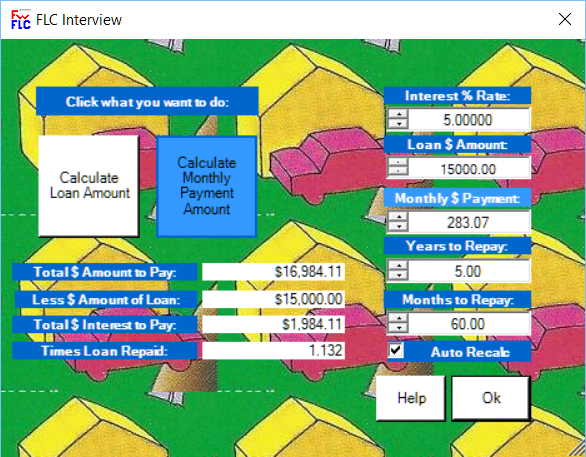

- You provide the loan amount, interest rate, months to repay, and it calculates the monthly payment.

- Produces a schedule showing the disposition of each payment, to principal and to interest, and the remaining balance throughout the life of the loan.

- Includes loan amortization and debt repayment acceleration features. Great for "what-if" analysis. Change your assumptions and one click recalculates everything.

- Easy to learn and use, FAMILY LOAN CALCULATOR is a tool every family needs.

Note: This product (FwFLC) is also included in Family Finances (FwFF) and Family Software Bundle (FwFSB).

Requirements:

- Windows Vista, 7, 8, 10, or Windows 11

- PC Desktop, Laptop, Tablet, or Notebook, Keyboard and Mouse

|

Family Loan Calculator(2017). Get out of debt. Calculates monthly payment based on loan amount, interest rate, and months to repay. Produces amortization schedule.Includes loan repayment acceleration features and "what-if" anlaysis. |

Download FwFLC

Download FwFLC

Key: Fw 20172 FLC 7213564 |

||

Concepts:

Loans

Interview Dialog Window:

Excerpts from FwFLC Help System:

How To Calculate a Monthly Mortgage Payment

Enter Loan Name: Click in the Loan Name field at the top right of the window. Type the name: Mortgage.Set Calculated: If the button under Monthly Payment does not say "Calculated" click the button so that it says "Calculated".

Set Loan Amount: Click in the Loan Amount field at the far left. Type in the mortgage loan amoount 280000.

Set Start Date: Click the drop down arrow under Loan Start Date and select the first of next month.

Set Interest Rate: Press

Set Term: Press

Click the [GO] button: The payment will be calculated and display in the Monthly Payment field ($1,503.10). When you click [GO] the results from an amortization process will display in the fields Amount Repaid, Loan Payoff Date, Interest Paid, Years Paid, and Principal Paid.

Click [Amortize] to display the amortization schedule: Notice how the monthly amount for interest gets smaller each month:

Example of an Amortization Schedule

Paying off a 30 year mortgage.

Paying off a 30 year mortgage.

Click [Print] to print preview the amortization schedule: You can also click the toolbar button with the printer icon at the top left of the Print Preview screen for a hard copy of the amortization schedule (optional). Note: The Amortization window and Print Preview windows will stay open until you close them. Close the Print Preview window but leave the Amortization window open.

Comparisons:

Position the Amortization window on the screen so that the total interest shown on the totals line ($261,116.20) is above the Interest Paid field. They should match. When will the loan be paid off (see Loan Paid Off Date)?Now change the Years To Repay from 30 to 15 years and click [GO]. The monthly payment will increase to $2,214.22 and the Interest Paid field will change to $118,559.99. So, how much interest would you save by paying the loan off in 15 years instead of 30? (Answer: $261,116.20 - $118,559.99 = $142,556.21 WOW!)

But, can you afford the increase in monthly payment ($2,214.22 - $1,503.10 = $ 711.12 more / mo )? Or, maybe the real question is: How can we afford not to pay more if it means saving $142,556.21? You can also save interest using other acceleration options (see below).

Note:

The total interest you will pay over time is not only based on the rate and years, but on the compounding policy in your lender's terms. This program assumes monthly compounding (charging 1/12th of the interest rate per month against the balance) but some lenders use daily compounding (charging 1/365th or 1/360th of the interest rate per day). Charging daily increases the total amount of interest you will pay due to the more frequent affect of paying interest on interest.File It.

Click File then Exit. Your entries will be saved for next time.Accelerating Payoff:

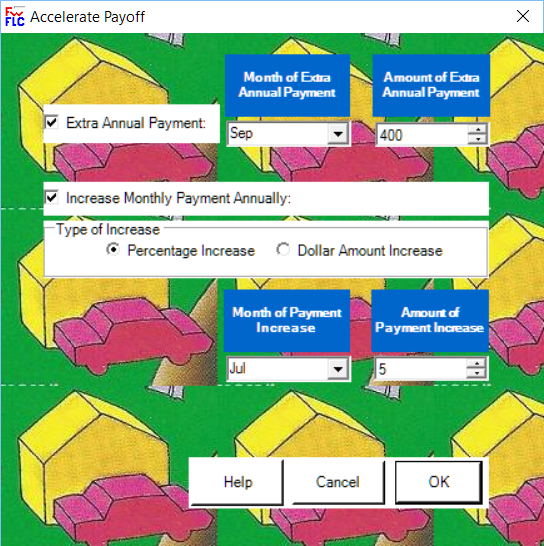

You can accelerate payoff by making an extra payment once a year, or, by increasing the monthly payment by a dollar amount or percentage on a specified month each year. Click the [Accelerate] button. If accelerated payoff options are selected the [Accelerate] button turns green. Accelerated results are shown on the amortization schedule. You can also simply make a larger monthly payment. This is done on the Main window. Deselect the Monthly Payment "Calculated" button (it will then say "Entered") then enter the larger monthly payment amount. (Once entered, years and months to repay will be recalculated.)