FwFSF

Family Savings Forecaster by FAMware (Free)

FwFSF

Family Savings Forecaster by FAMware (Free)

Product Info

FAMILY SAVINGS FORECASTER assists you with formulating a savings plan.

Features:

- Produce a savings forecast schedule based on the interest rate, number of months, target balance, and monthly amount. See how your savings balance will accumulate over time.

- Allows you to set up "what-if" scenarios, such as an annual increase in your monthly savings amount or an extra annual payment, to see how you can more rapidly achieve your family or personal savings goals.

- Calcuates your monthly savings amount (or any of the other savings variables) based on the assumptions you enter.

- Easy to use. Keep separate forecasts for each savings goal. Save for kids college. Save for a family vacation or trip. Plan for retirement! Every family needs this tool.

Note: This product (FwFSF) is also included in Family Finances (FwFF) and Family Software Bundle (FwFSB).

Requirements:

- Windows Vista, 7, 8, 10, or Windows 11

- PC Desktop, Laptop, Tablet, or Notebook, Keyboard and Mouse

|

Family Savings Forecaster(2017). Save for the future. Calculates amount needed to save each month to reach a target savings balance based on interest rate and months to save. Produces month to month forecast schedule.Includes acceleration features and "what-if" analysis. |

Download FwFSF

Download FwFSF

Key: Fw 20172 FLC 7213564 |

||

Concepts:

Savings Amount |

Rate |

Years |

Forecast (Target) |

|||||

$106.40 |

5.65% |

30 |

? |

Click for Answer |

||||

$225.55 |

5.65% |

20 |

? |

See Example Below |

How does one get a rate of return of 5.65%? By conservatively investing in the stock market.

Twenty years ago the average return on the stock market was 5.65%. Today it is closer to 10%.

Buy into a mutual fund tied to the Dow Jones Inductrial Average, or Standard and Poors 500 index.

Invest $100 per month via Dollar Cost Averaging (or similar feature), or whatever amount you can afford, and watch it grow over time.

This is another good reason to create a budget, so you know how much you can afford to invest

each month.

Interview Dialog Window:

Excerpts from FwFSF Help System:

How To Calculate a Monthly Savings Amount

Enter Forecast Name: Click in the Forecast Name field at the top right of the window. Type the name: College for Sharon.Set Calculated: If the button under Monthly Payment does not say "Calculated" click the button so that it says "Calculated".

Enter Target Amount: Click in the Target Amount field at the far left. Type in the amount of 100000 (just the number no commas nor $ sign).

Set Start Date: Click the drop down arrow under Savings Start Date and select the first of next month.

Set Interest Rate: Press

Set Years: Press

Click Go: Click the [GO] button on either side of the screen. The amount will be calculated and display in the Monthly Payment field ($304.60). When you click [GO] the results will display in the fields Total Savings, Savings End Date, Interest Earned, Years, and Amount Paid.

Forecast: Click [Forecast] to display the savings forecast schedule. Notice how the amount added to the savings balance gets larger each month as interest on the balance grows.

Printing: Click [Print] to print preview the forecast schedule. Click the toolbar button with the printer icon at the top left of the Print Preview screen for a hard copy of the schedule (optional). Note: The Savings Forecast window and Print Preview windows will stay open until you close them. Close the Print Preview window but leave the Savings Forecast window open.

Comparing Scenarios: Position the Savings Forecast window on the screen so that the total interest shown on the totals line ($26,896.58) is above the Interest Earned field. They should match. When will the target savings balance be achieved (see Savings End Date)?

10 Years: Now change the Years To Save from 20 to 10 years and click [GO]. The monthly payment will increase to $715.61 and the amount in the Interest Earned field will decrease to $14,127.11. So, how much more interest would you earn by saving $304.60 per month at a 3% interest earnings rate for 20 years instead of $715.61 per month for 10 years? (Answer: $26,896.58 - $14,127.11 = $12,769.47). Either way you accumulate $100,000 for College for Sharon but your cumulative out of pocket amount will be less and the your cumulative interest earned will be more, if you start saving earlier.

File It: Click File then Exit. Your entries will be saved for next time.

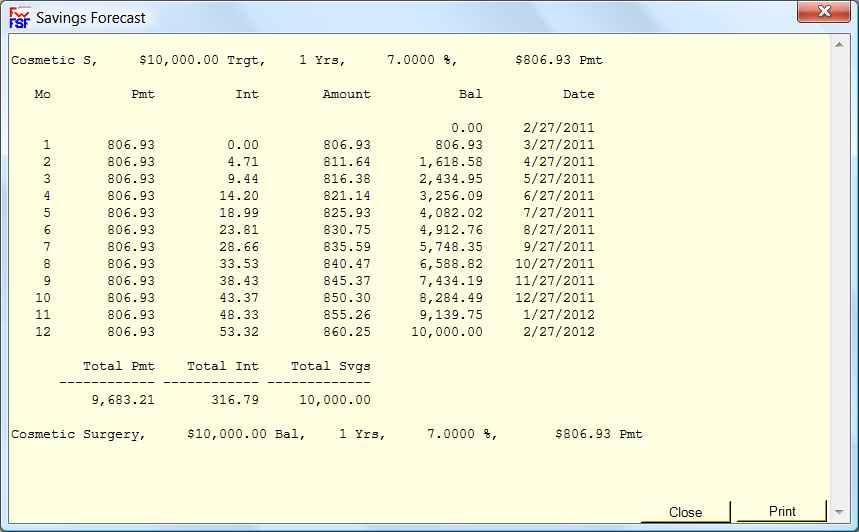

Example of a Savings Forecast Printout

Saving up for cosmetic surgery.

Saving up for cosmetic surgery.

Accelerated Savings

You can reach your savings goal faster by making additional payments. You can make an extra payment once each year, or, you can increase the amount of the monthly payment by a dollar amount or percentage at a specified month each year, or you can do both. A third option is simply to increase the amount of the monthly payment. All three of these options reduce the time it will take to reach the target.Make An Extra Payment Each Year: Check the Extra Annual Payment checkbox. Select the month of the extra payment. Select the amount of the extra payment. This will be applied to the savings forecast in the month specified. This is usually done at the end of the year when you may have received an annual bonus or perhaps a dividend.

Increase the Payment Amount Each Year: Check the Increase Monthly Payment Annually checkbox. Select the month of the increase. Select the type of increase (dollar increase or percentage increase). Select the amount of the increase. This will be applied to the savings forecast in the month specfied each year. You might think of this as the month in which you can expect your annual raise or increase at work. Apply some of that increase to the monthly payment and get to your target earlier.