In this example the family borrowed $200,000 for a mortgage on their home, with a 30 year term, and an interest rate of 5.625%. The required monthly payment is $1151.31.

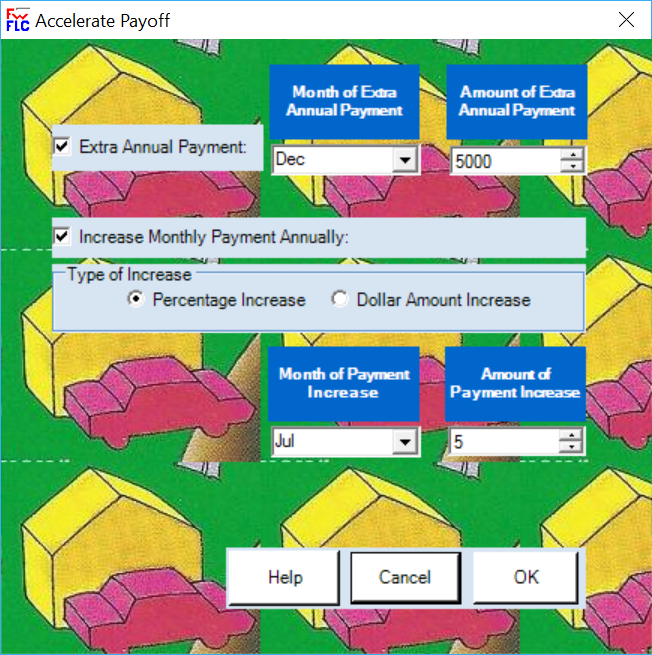

Making an extra principal payment of $5,000 once each year in December, and increasing the amount of the monthly payment by 5% each July (to match your expected annual raise), the loan is paid off in

less than half the time (from 360 to 143 months) and

interest and total out-of-pocket costs are substantially reduced (from $414,472 to $283,444).

Notice also that

in the last month of the schedule, December, the extra payment reduces from $5000 to $3575.47

to match the balance payoff amount.

Loaded With Features.

Loaded With Features.

Personal and family finances software.

- Save For The Future

- Amortize Your Loans

- Learn How to Budget

- Get With the 'Program'

- Pay Off Your Mortgage

- Balance Your Checkbook

- Calculate Your Loan Payment

- Pay Off Your Credit Cards

- Calculate Your Net Worth

- Hang On To Your Earnings

- Quit Fighting About Money

- Make Better Family Decisions

- Plan For Retirement

- Analyze Expenditures

- Document Your Home Inventory

- Put Your Financial House in Order