FwFF

Family Finances by FAMware (Free)

FwFF

Family Finances by FAMware (Free)

FwFF Main Window:

Product Info

FAMILY FINANCES contains personal and family financial management tools. Features a complete budgeting system, savings and loan calculators, home inventory, decision making, credit card management, balancing the checkbook, tips for financial marital problems, and more. Great for learning how to set up and balance a budget and follow the budget cycle.

Features:

- Includes built-in and user defined budget categories.

- FwFF includes balancing the checkbook, managing credit cards, calculating net worth, and tips on how marriage partners can stop fighting about money.

- FwFF includes these stand-alone products:

- Family Savings Forecaster ( FwFSF )

- Family Loan Calculator ( FwFLC )

- Family Home Inventory ( FwFHI )

- Family Decisions ( FwFD )

- Family Message of the Day ( FwMOTD )

- Note: Family Finances includes the same budgeting features as found in Family Budget (FwFB).

- Note: Family Finances (FwFF) is different than the Family Finances Bundle (FwFFB) package in that Finance Finances (this package) only contains finance related software tools and modules (no genealogy).

Requirements:

- Windows Vista, 7, 8, 10, or Windows 11

- PC Desktop, Laptop, Tablet, or Notebook, Keyboard and Mouse

|

Family Finances(2017). Contains personal and family financial management tools. Features a complete budgeting system, savings and loan calculators, home inventory, decision making, credit card management, balancing the checkbook, tips for financial marital problems, and more. Great for learning how to set up and balance a budget and follow the budget cycle. |

Download FwFF

Download FwFF

Key: Fw 20176 FF 7213564 |

||

Concepts:

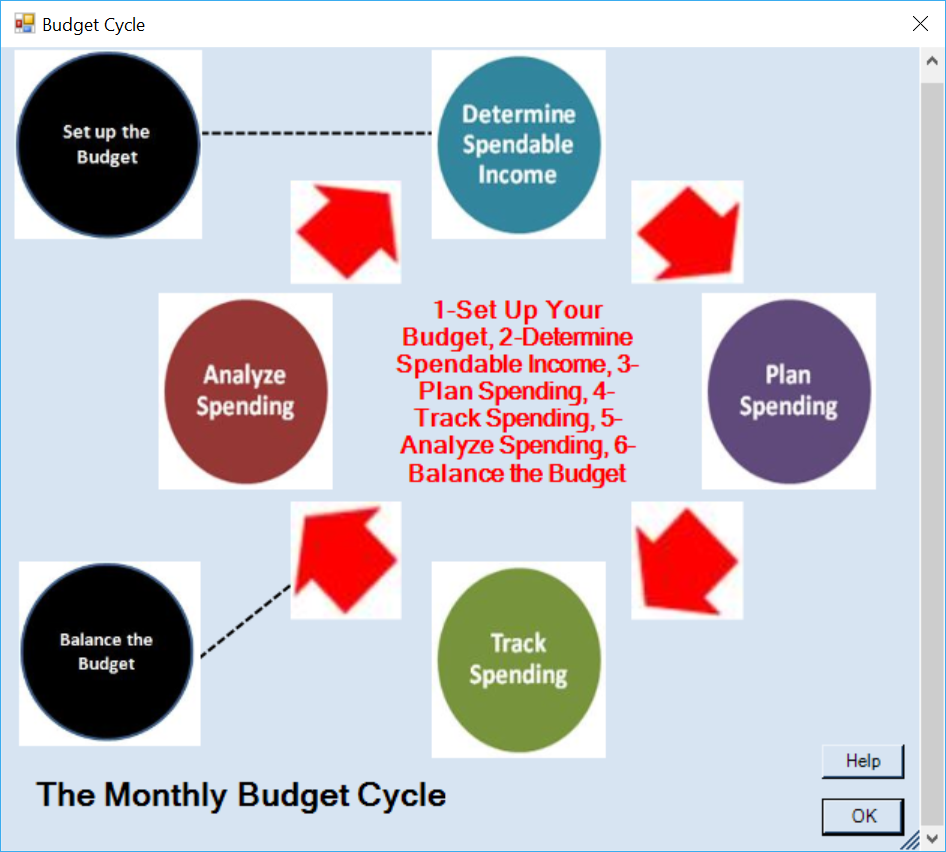

Budget Cycle

Budget Cycle

FwFF Features (continued):

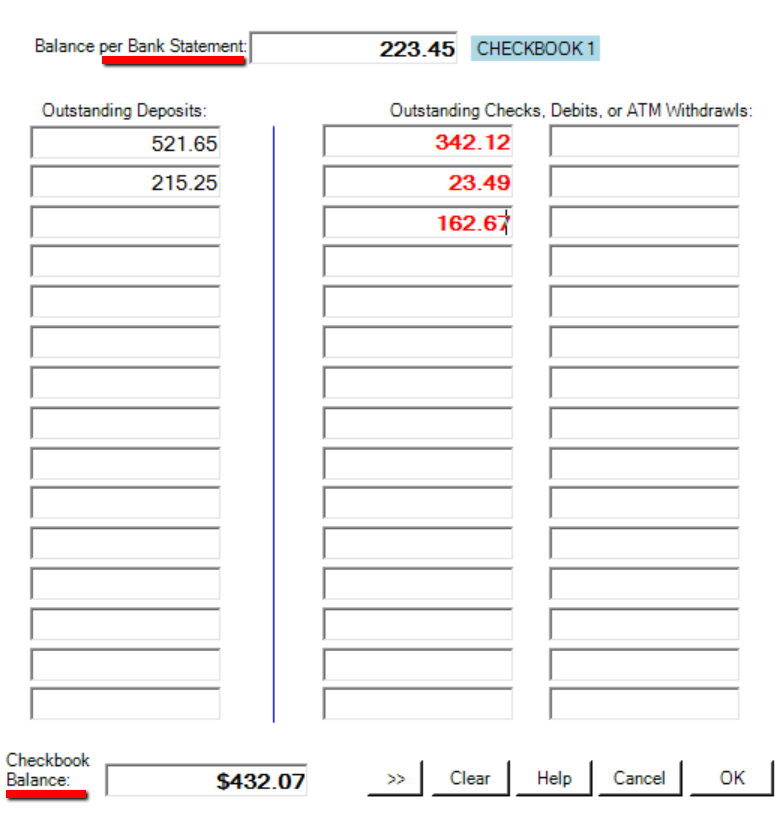

Reconcile Your Checkbook

Enter current bank balance (from bank statement or online access) and outstanding checks and deposits (from check register or carbon copies -- these haven't yet cleared the bank). The program calculates your actual checkbook balance. Why do it long-hand when you have a computer?

Enter what's cleared the bank, then enter outstanding checks and deposits. See real checkbook balance below.

|

|

Pay Off Your Credit Cards

Pay off one credit card then add that payment to the next card. Family Finances will help you select which cards to focus on first, then second, then third, etc., to minimize your out-of-pocket interest costs.

| Credit Card | Monthly Payment | Monthly Payment |

Monthly Payment |

Monthly Payment |

Monthly Payment |

Monthly Payment |

|

$100 | $100 | paid | |||

|

$100 | $100 | $200 | paid | ||

|

$100 | $100 | $100 | $300 | $300 | paid |

Quit Fighting About Money

Calculate Your Net Worth

What is your net worth now? What will it be when you retire? What would it be now for your surviving spouse? What would it be in retirement for your surviving spouse? What will it be 10 years from now? What will it be 20 years from now? Family Finances facilitates all of these calculations.

|

Now | Now Survivor | Forecasted (10 years) | Forecasted (20 yrs) | Retired | Retired Survivor |

| ASSETS | $200,000 | $200,000 | $220,000 | $250,000 | $350,000 | $400,000 |

| LIABILITIES | -$180,000 | -$80,000 | -$150,000 | -$120,000 | $0 | $0 |

| NET WORTH | $20,000 | $120,000 | $70,000 | $130,000 | $350,000 | $400,000 |

Assumptions:

- If you die your spouse will receive $100,000 in life insurance reducing your mortgage balance to $80,000.

- In 10 years you will have reduced your mortgage by $30,000 and your savings by $20,000, increasing your Net Worth by $50,000, from $20,000 to $70,000.

- In another 10 years you will have reduced your mortgage by another $30,000 and your savings by $30,000, increasing your Net Worth to $130,000.

- By the time you retire, 30 years from now, your mortgage will be paid off.

- If you die in retirement your spouse will receive $50,000 in life insurance.

Plan for Retirement

Planning Scenarios:

| Now | Current budget with both spouses working |

| Retired | Estimated budget when both spouses retire |

| Survivor Now | Current budget with one spouse deceased |

| Survivor Retired | Estimated budget in retirement with one suriving spouse. |